As the world shifts towards a cleaner, electrified future, one metal stands at the forefront of...

Where Will All the Copper Come From?

I recently had the honor of presenting at the PowerGen 2025 Conference in Dallas, TX, on a crucial topic: “Where Will All the Copper Come From?” This is a pressing question for the power generation industry, as copper is a critical material for enabling efficient equipment operations, power production, and grid distribution. If you haven’t heard, copper demand is set to surge in the next 10-15 years as electrification accelerates across industries.

My presentation explored the challenges and opportunities in securing U.S. copper supplies from three key sources: domestic mining and refining, recycling, and continued trade with reliable partners, including Chile, Peru, Canada and Mexico. As we transition to cleaner power sources over the next decade, ensuring a stable copper supply will be critical to meeting our growing energy needs.

Why Copper Matters

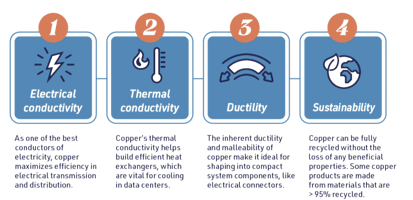

So, what makes copper so special? Simply put, its unmatched conductivity sets the standard for electrical performance. Its flexibility and ease of fabrication further enhance its value in applications ranging from power cables to transformers and renewable energy systems.

At the Copper Development Association (CDA), we represent the U.S. copper industry and bring the value of copper to society, working alongside the International Copper Association (ICA) to promote, protect and defend copper in the United States. Through our efforts, we help industries navigate the evolving copper landscape and address market challenges and opportunities.

Challenges to U.S. Copper Supply

Despite being the fifth-largest copper producing region in the world, the U.S. faces significant hurdles in maintaining a reliable copper supply:

- Lengthy Permitting Delays: Mining projects in the U.S. takes an average of 29 years to navigate the permitting process – the second longest timeline globally. Many copper reserves are located on or near federal land, further complicating approvals.

- Underutilized Recycling Potential: The U.S. exports more than 50% of all the copper scrap it generates instead of recycling it domestically.

- Rising Import Dependency: The U.S. imports nearly 50% of its refined copper needs, and this figure is projected to reach 60% by 2035 if domestic production and refining capacity do not expand.

In contrast, Canada and Australia attract significantly higher investment per ton of copper produced due to more streamlined regulatory processes. If the U.S. does not take action, we risk falling behind in securing our own copper resources.

Opportunities to Strengthen U.S. Copper Supply

Despite these challenges, the U.S. has significant opportunities to secure its future supply of copper:

- Domestic Mining & Refining Growth: If key mining projects receive approval, the U.S. can expand production and refining capacity.

- Urban Mining & Recycling: The U.S. has the second largest supply of secondary copper in the world, with 86 million tons of copper still in use today – our Urban Mine. Increasing domestic recycling of copper scrap would enhance sustainability and augment supply.

- Reliable Trade Partnerships: The U.S. benefits from Free Trade Agreements (FTAs) with major copper-producing countries like Chile, Peru, Canada, and Mexico. However, these nations also supply to other countries and are not projected to increase production fast enough to meet U.S. needs alone, reinforcing the need for an all-of-the-above sourcing strategy that also involves increased domestic mining, refining and recycling.

Copper Supply Scenarios: What’s at Stake?

Two potential copper supply scenarios through 2035 highlight the urgency of action. In the first scenario, Expanded Domestic Production & Refining, key U.S. mines receive approval and begin production, allowing domestic output to grow. Imports from Free Trade Agreement (FTA) countries such as Chile, Peru, Canada, and Mexico remain stable, ensuring a secure and diversified supply chain. As a result, reliance on non-FTA imports remains limited, reducing geopolitical risks and strengthening long-term supply security.

In contrast, the Restricted Domestic Growth & Import Constraints scenario presents significant challenges. If new mining projects are not approved, domestic production remains stagnant, creating a shortfall in meeting demand. At the same time, disruptions such as the Panama Canal crisis could restrict shipping routes, further tightening supply chains and increasing costs. As a result, U.S. dependence on foreign copper could exceed 60%, forcing greater reliance on non-FTA countries with less predictable trade policies. Without a proactive approach to securing domestic supply through mining, refining, recycling, and strategic trade agreements, the U.S. risks severe supply bottlenecks that could impact not only the power sector but also national security and economic stability.

Time to #GiveCopperCredit

Many nations already recognize copper as a critical mineral and are taking steps to secure their domestic supplies. Yet, the U.S. Geological Survey (USGS) has not classified copper as a critical mineral – despite its critical role in energy, defense, manufacturing, and the economy.

To address this, Congress has introduced the Critical Minerals Consistency Act. This bill ensures that any material deemed critical by the Department of Energy (DOE) is also classified as a critical mineral by USGS. This designation would unlock policy tools to strengthen copper supply chains and incentivize investment.

Ensuring a sustainable, secure, and resilient copper supply requires an all-of-the-above strategy that includes:

- Increasing domestic mining and refining capacity

- Expanding recycling and secondary copper recovery

- Maintaining strong trade relationships with reliable trade partners, including Chile, Peru, Canada and Mexico.

We must take action now to secure the copper resources needed for the electrified future.

Want to learn more? Click here to receive a copy of my PowerGen 2025 presentation, “Where Will All the Copper Come From?”